how do business loans work australia

The decision to seek outside funding for your business is a big oneSince the onset of the COVID-19 pandemic its more important than ever for small businesses to recover and thrive. A business line of credit is like a credit card for businesses.

Small Business Loans A Guide For Smb Owners Quickbooks Australia

Buying more stock to increase your sales and profits.

. For example if you take out a loan for 50000 and the interest rate on the loan is 5 the simple interest. Compare rates terms fees for free. Business Line of Credit.

Buying equipment and machinery to grow your business. Heres a simple example. You get approved for a specific amount for example 20k per month and you can borrow and pay back up to.

For example Australian student loans are interest-free until the borrower reaches a certain income threshold. It determines how much interest you end up paying. Ongoing fees include monthly home loan fees 5-15 a month and annual package fees which can range from 248 to 400 a year.

Best Business Loan rates. Take a look at the Australia Startups resources section and learn more about how business loan work right now. Small business loans may be used for a variety of purposes start-up expansion working capital asset purchase debt repayment.

Factor fees typically range from 050 to 5 for each month an. How do startup business loans work. The lowest business loan interest rates will be applied to business loans secured against property and where the asset being financed will be used as security.

Announcing Valiants 125m series B funding. As a rule of thumb most lenders will consider a 12. The lower the interest rate the cheaper your loan will be.

You borrow 500000 over 30 years with an. As with any loan or credit arrangement startup business loans work the same way. In general interest is calculated on a per annum pa basis but is paid monthly.

Depending on your risk profile and your capacity to service your repayments you may be able to borrow between 5000 and 600000. Even the purchase of a business. Heres a simple example.

Quick and efficient access to loans for small businesses. End-of-loan fees Some lenders may include. How Does The Business Loans Centre Work.

1 you enter into a contract to borrow the money you need. After collection the factoring company pays your business the remaining balance minus the factoring fees. ISelect does not arrange business loans products but can refer you to Valiant who does provide such services and can.

Understand your loan purpose. Get Offers From Top 7 Online Lenders. It involves having access to credit when you need it instead of searching for ways to use a lump sum loan.

The Federal Government is providing an exemption from responsible lending obligations for lenders providing credit to existing small. Loans between 5K to 20M. Prospa is Australias 1 online lender to small business and we support local Australian businesses with easy and hassle-free application on small business loans with a quick.

Valiant Finance are pleased to announce that we have secured 125 million in our Series B equity funding. Once that income is reached repayment for the 2020-2021. Our business loans Australia are available for 3 24 months and start at just 5000 moving up to 150000.

No asset security required upfront to access Prospa funding up to 150000. You can use secured business finance for a wide range of purposes including. Business Loans Centre Australia dedicates itself to increasing the opportunities for business owners around Australia by delivering fast unsecured.

Here are eight steps worth taking before you apply for a business loan. Being clear on why you want to borrow is the first step to choosing the right loan and. The revolving business loan has a repayment period that covers two phases where you first get to draw the credit use it repay it.

How Long Does It Take To Get An Sba Loan Funding Circle

Ondeck Has Lent 6 Billion To Small And Medium Business Shawn Chittle Tech Product Leadership Product Design

How Do Low Doc And No Doc Home Loans In Australia Work

Best Business Loans For 2022 Businessnewsdaily Com

Small Business Loan Requirements Business Org

Small Business Loans Up To 150 000 Kabbage From American Express

Lendio Your One Stop Shop For Business Finances

8 Ways To Get Money To Start A Small Business

Buy Now Pay Later Five Business Models To Compete Mckinsey

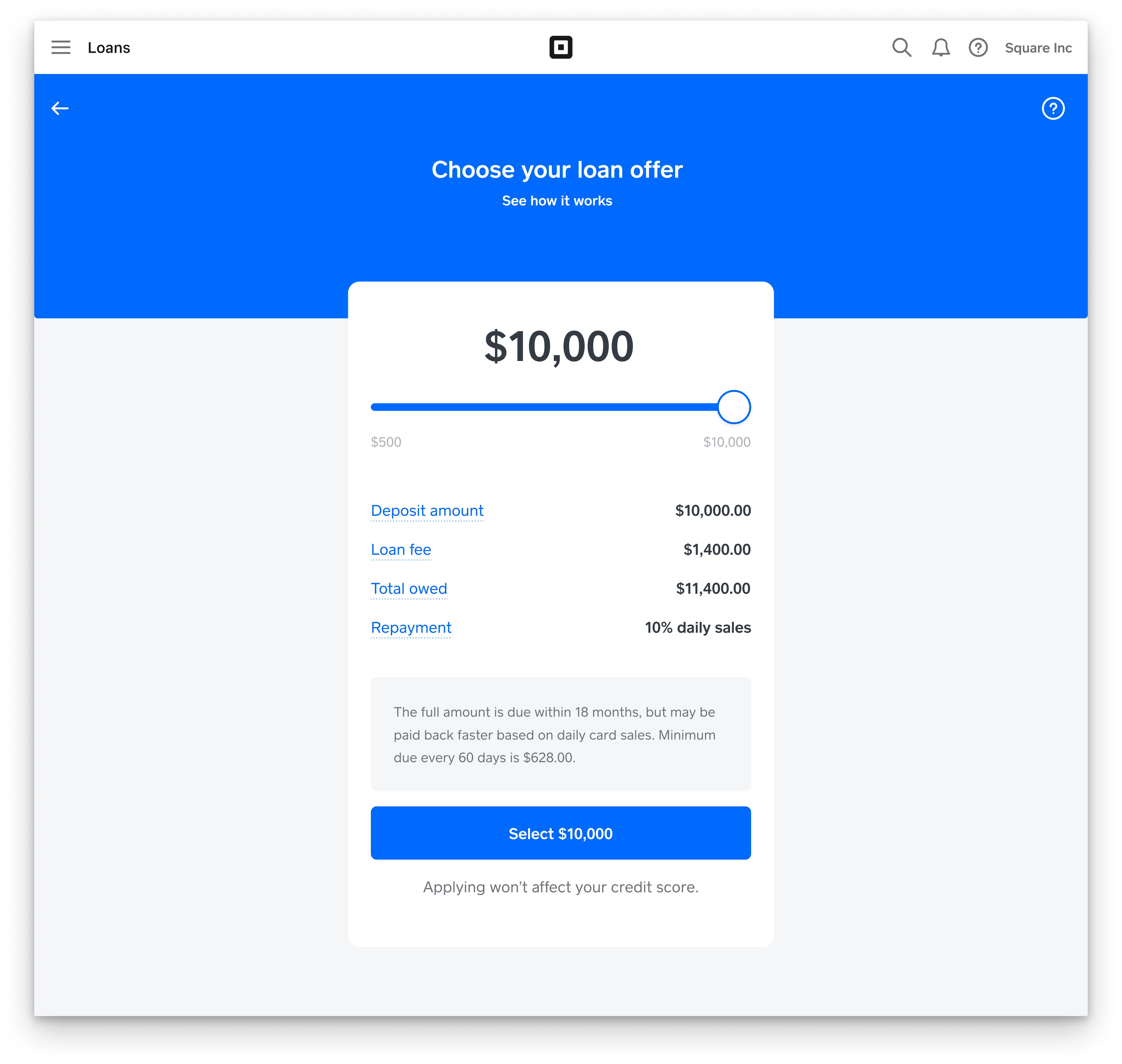

Square Loan Eligibility Faq Square Support Center Us

A Comprehensive Guide To Getting A Business Loan In Australia

Prospa S Digital Growth Strategy A Full Breakdown Of The Digital By Alex Cleanthous Medium

Understanding Common Small Business Loan Terms Ondeck

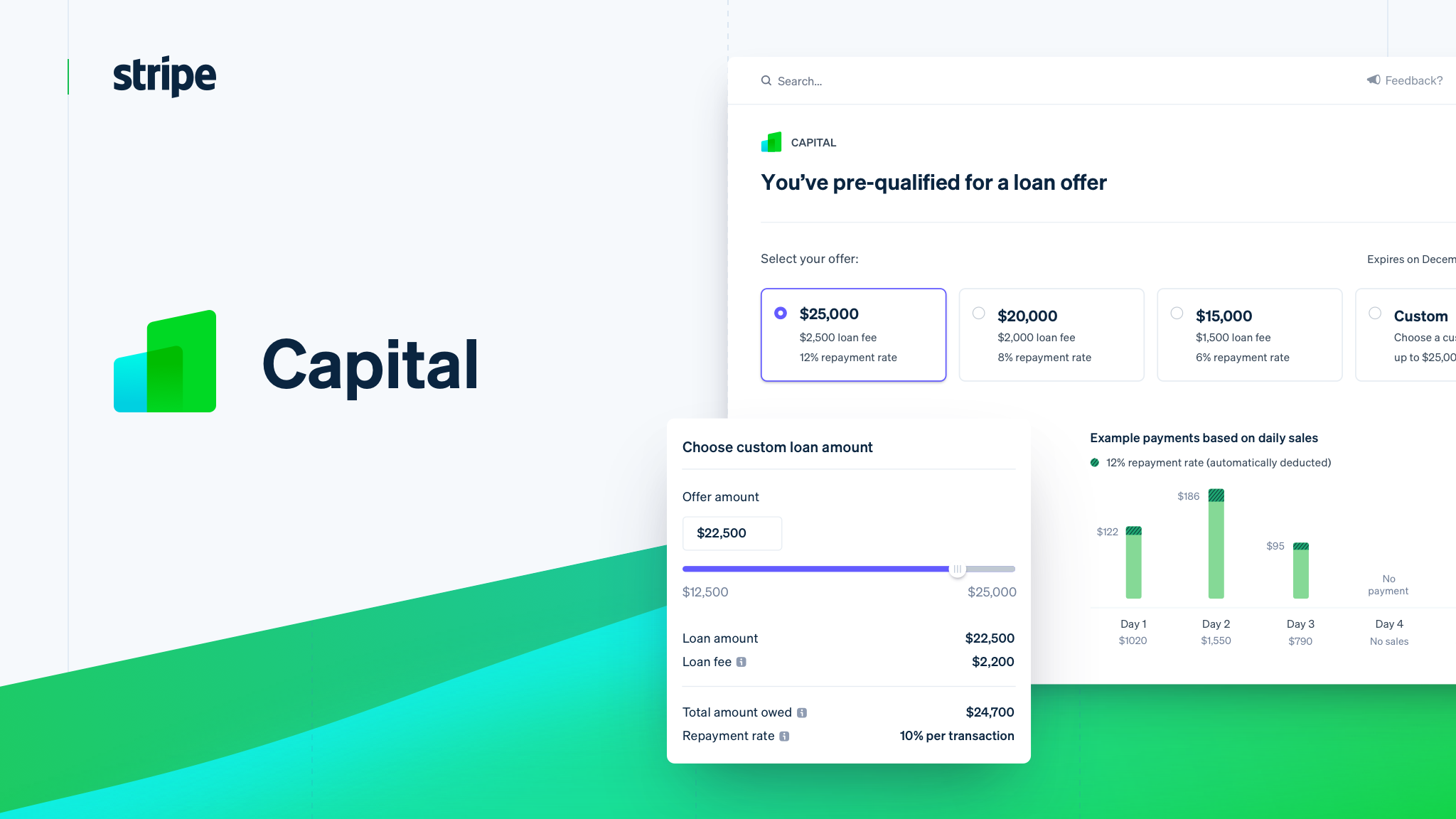

Stripe Capital Loans For Small Businesses Startups And More

What Banks Look For When Reviewing A Loan Application Wolters Kluwer

Top Ppp Loan Lenders Updated Approved Banks Providers

Why 2020 Could Be The Best Year To Take Out A Business Loan